In the tech industry, tax deductions and credits can play a significant role in reducing your overall tax burden. By understanding how these deductions and credits work, you can maximize your savings and keep more of your hard-earned money in your pocket. In this article, we will explore the various deductions and credits available to tech professionals and provide tips on how to take advantage of them.

What are Tax Deductions?

Tax deductions are expenses that you can subtract from your taxable income, reducing the amount of income that is subject to taxation. For tech professionals, common deductions include expenses related to professional development, equipment purchases, and home office expenses. By keeping track of these expenses throughout the year, you can potentially lower your taxable income and save money on taxes.

Types of Tax Credits

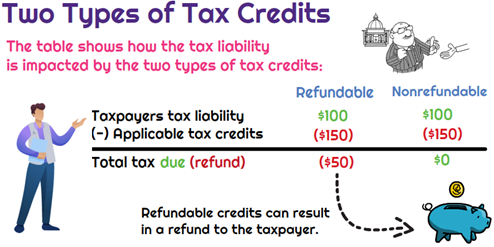

Tax credits, on the other hand, are direct reductions in the amount of tax you owe. Unlike deductions, which reduce your taxable income, tax credits are applied directly to your tax bill. There are several tax credits available to tech professionals, including the Research and Development Tax Credit and the Energy-Efficient Home Improvements Credit. By taking advantage of these credits, you can further reduce your tax liability and increase your savings.

Maximizing Your Deductions

To maximize your deductions as a tech professional, it is essential to keep detailed records of all your expenses throughout the year. This includes receipts for equipment purchases, professional development courses, and any other expenses related to your work. By keeping accurate records, you can ensure that you are not missing out on any potential deductions and credits that could save you money on your taxes.

Utilizing Tax Credits

In addition to maximizing your deductions, you should also be aware of and take advantage of any tax credits for which you may be eligible. The Research and Development Tax Credit, for example, can provide significant savings for tech professionals who are involved in research and development activities. By documenting your research projects and expenses, you can claim this credit and lower your tax bill.

Seeking Professional Help

While it is essential to understand the basics of tax deductions and credits as a tech professional, it can be beneficial to seek professional help to ensure that you are maximizing your savings. A tax professional with experience working with tech professionals can help you identify all eligible deductions and credits and ensure that you are taking full advantage of them.

Conclusion

As a tech professional, understanding tax deductions and credits can help you save money and reduce your tax burden. By keeping detailed records of your expenses, maximizing your deductions, and taking advantage of tax credits, you can minimize your tax liability and keep more of your hard-earned money. Consider seeking professional help to ensure that you are maximizing your savings and taking advantage of all available tax benefits.

Remember, staying informed and proactive about tax deductions and credits can make a significant difference in your overall financial well-being as a tech professional.