Planning for retirement is a crucial part of financial management. Knowing how much money you will need during your retirement years can help you save and invest wisely to ensure a comfortable lifestyle. In this article, we will discuss how to calculate your retirement needs.

Assess Your Current Expenses

The first step in calculating your retirement needs is to assess your current expenses. Take a look at your monthly bills, including housing, utilities, groceries, transportation, healthcare, and any other regular expenses. Consider how your expenses may change in retirement, such as travel or healthcare costs.

Estimate Your Retirement Income

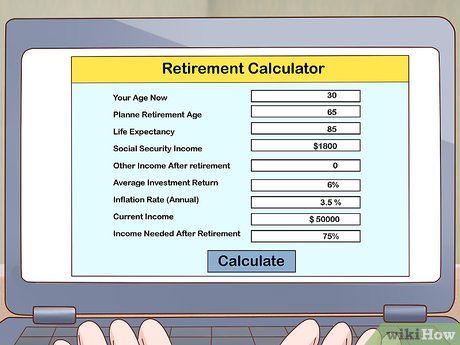

Next, estimate your retirement income sources. This may include Social Security benefits, pensions, annuities, and any income from retirement accounts or investments. Calculate the total amount of income you expect to receive each month during retirement.

Calculate the Gap

Once you have assessed your expenses and estimated your retirement income, calculate the gap between the two. This is the amount of money you will need to supplement your income during retirement. Consider factors such as inflation and potential healthcare costs when determining this amount.

Factor in Taxes

Don’t forget to factor in taxes when calculating your retirement needs. Consider how much of your income will be subject to taxes and how that will impact your overall retirement budget. Consult with a tax professional for guidance on this issue.

Account for Longevity

It’s important to consider your life expectancy when calculating your retirement needs. The longer you live, the more money you will need for retirement. Factor in the potential for a long and healthy retirement when planning your finances.

Consult with a Financial Advisor

Calculating your retirement needs can be complex, and it’s always a good idea to consult with a financial advisor. An advisor can help you take into account all the factors that may impact your retirement finances and create a personalized plan to meet your needs.

Start Saving and Investing Now

Once you have calculated your retirement needs, it’s time to start saving and investing for the future. Consider contributing to retirement accounts such as IRAs, 401(k)s, or other investment vehicles. The earlier you start, the more time your money will have to grow.

Planning for retirement may seem daunting, but with careful planning and the help of a financial advisor, you can ensure a comfortable and secure future. Calculate your retirement needs today and take the necessary steps to prepare for your golden years.

This comprehensive guide provides a step-by-step approach to determining your retirement needs and taking control of your financial future. By following these tips, you can make informed decisions about saving, investing, and planning for your retirement. It’s never too early to start thinking about your financial future, so take the first step today.