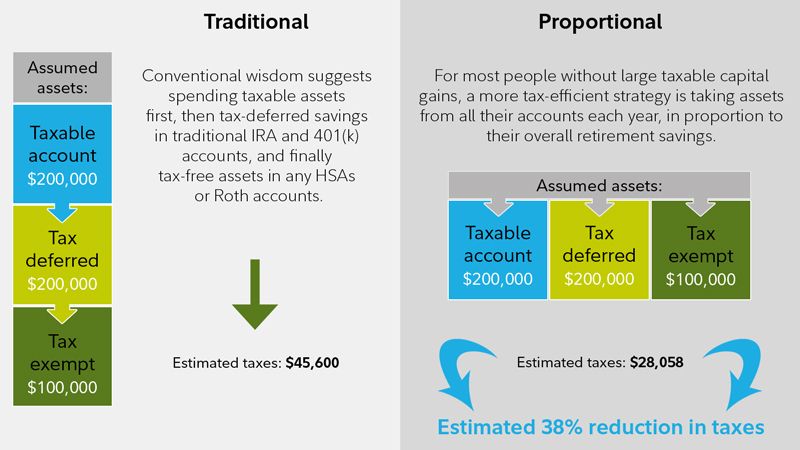

Retirement planning is a crucial aspect of financial stability, and one key component of a successful retirement plan is maximizing tax advantages. By taking advantage of tax-advantaged retirement savings strategies, individuals can ensure that they are saving efficiently and optimizing their future financial security. In this article, we will explore some of the top tax-advantaged retirement savings strategies that tech-savvy individuals can use to build their retirement nest egg.

Tax Planning

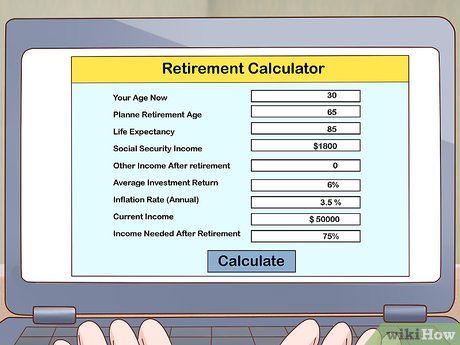

How to Calculate Your Retirement Needs

Planning for retirement is a crucial part of financial management. Knowing how much money you will need during your retirement years can help you save and invest wisely to ensure a comfortable lifestyle. In this article, we will discuss how to calculate your retirement needs.

Planning for Early Retirement: Steps to Get There

Retirement may seem far off, but planning for it early can provide you with financial security and peace of mind. Early retirement is a goal for many, but it requires careful planning and diligent saving. In this article, we will discuss the steps you can take to plan for early retirement in the tech niche.

Understanding Social Security: What You Need to Know

If you’re like most people, Social Security can be a confusing topic. The program is important for millions of Americans, providing financial assistance to retirees, disabled individuals, and survivors of deceased workers. In this article, we will break down the basics of Social Security, how it works, and what you need to know to make the most of this vital program.

Retirement Planning Mistakes to Avoid

Retirement planning is a crucial aspect of your financial strategy. It involves making decisions about your future financial security and how you will support yourself once you stop working. However, many people make common mistakes that can hinder their ability to retire comfortably.

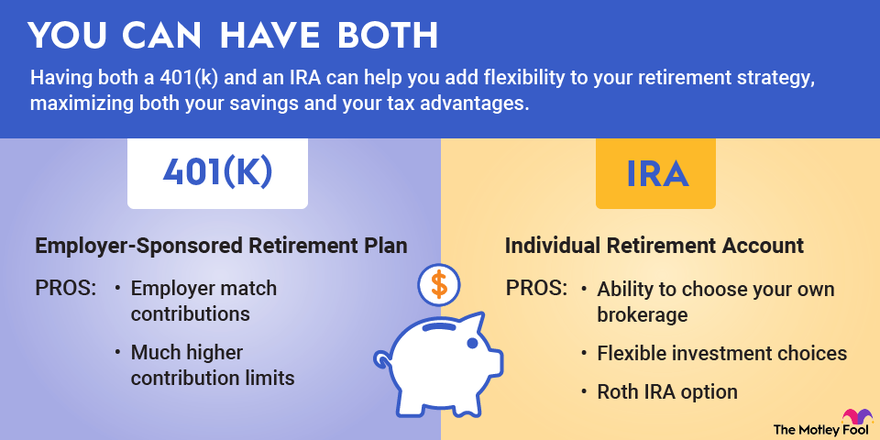

How to Maximize Your 401(k) and IRA Savings

When it comes to planning for retirement, one of the most important things you can do is to maximize your savings in your 401(k) and IRA accounts. These accounts offer valuable tax advantages and can help you build a secure financial future. In this article, we will discuss how you can make the most of your retirement savings by maximizing your contributions to your 401(k) and IRA accounts.

The Best Retirement Accounts for Long-Term Growth

Planning for retirement is essential for securing your financial future. One of the best ways to save for retirement is through retirement accounts that offer long-term growth potential. In this article, we will explore the best retirement accounts that can help you grow your savings over time.

How Much Should You Save for Retirement?

Retirement may seem like a far-off dream for many of us, but it’s essential to start planning and saving for it as early as possible. The earlier you start saving, the more time your money will have to grow through the magic of compound interest.