In the tech industry, tax deductions and credits can play a significant role in reducing your overall tax burden. By understanding how these deductions and credits work, you can maximize your savings and keep more of your hard-earned money in your pocket. In this article, we will explore the various deductions and credits available to tech professionals and provide tips on how to take advantage of them.

Blog

The Benefits of Hiring a Tax Planner

In today’s complex and ever-changing tax landscape, it can be difficult for individuals and businesses to navigate the various regulations and tax laws. That’s where a tax planner comes in. A tax planner is a professional who specializes in helping clients minimize their tax liabilities while ensuring compliance with all relevant tax laws. Here are some of the key benefits of hiring a tax planner:

How to Lower Your Tax Bill Legally

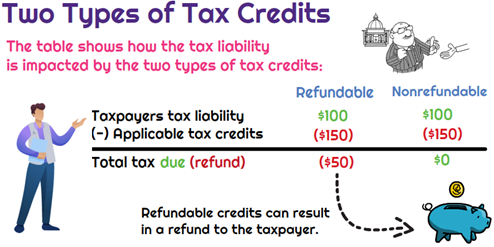

When it comes to taxes, finding legal ways to lower your tax bill is always a smart move. With the right strategies and proper planning, you can maximize your savings and keep more of your hard-earned money in your pocket. Here are some tips on how to lower your tax bill legally:

Essential Tax Planning Strategies for Individuals

As a tech professional, you have likely focused on honing your skills and staying ahead in your industry. However, tax planning is just as important as staying up-to-date with the latest advancements in technology. By implementing effective tax planning strategies, you can minimize your tax liability and maximize your financial resources for future endeavors.

Expert Tips for Managing Retirement Income

One of the most fundamental steps in managing your retirement income is creating a budget. With the help of budgeting apps and software, you can track your expenses, monitor your spending habits, and identify areas where you can cut costs. By having a clear picture of your financial situation, you can make informed decisions about how to allocate your retirement income.