As technology continues to advance and the world becomes increasingly interconnected, the need for reliable income protection has never been more important. For individuals working in the tech industry, where long hours and high stress levels are common, disability insurance is a crucial safety net that can provide financial security in the event of a disabling injury or illness.

Blog

Understanding Health Insurance and How to Save

Health insurance is a crucial aspect of financial planning for individuals and families. With rising healthcare costs, having the right health insurance coverage can provide peace of mind and protect you from unexpected medical expenses. In this article, we will discuss the basics of health insurance, how to choose the right plan, and tips on how to save on your health insurance premiums.

Life Insurance: How to Choose the Right Policy

Life insurance is a crucial financial product that provides financial protection to your loved ones in case of your death. There are several types of life insurance policies available, including term life, whole life, and universal life insurance. It is important to understand the differences between these policies before choosing the right one for your needs.

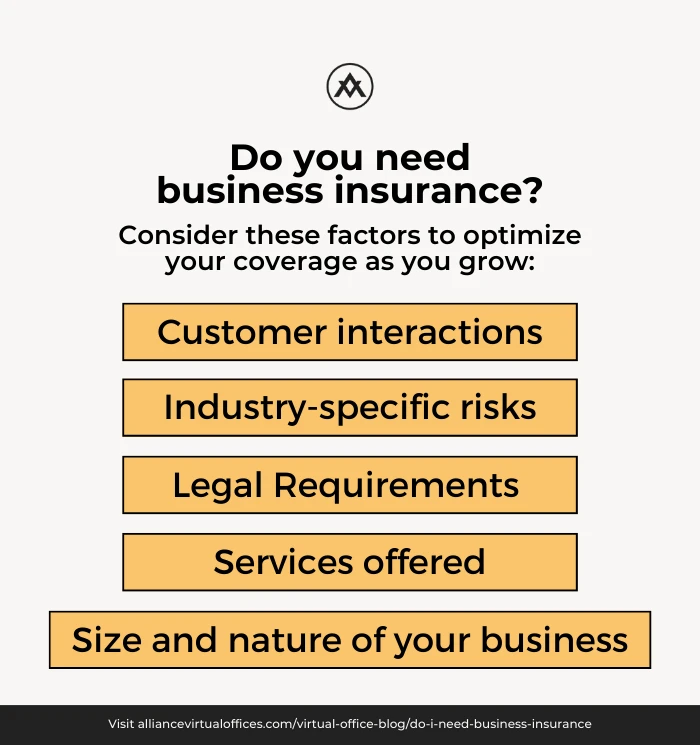

Comprehensive Guide to Insurance: What You Need

Insurance can be a complex and overwhelming topic, but it is essential for protecting yourself, your assets, and your loved ones from unexpected events. In this comprehensive guide, we will break down the basics of insurance, explain the different types of coverage available, and provide tips on how to choose the right insurance for your needs.

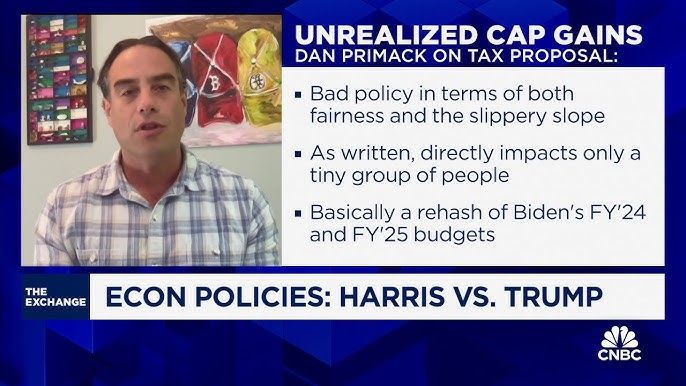

How to Plan for Capital Gains Tax

Capital gains tax is a tax on the profit from the sale of an asset such as stocks, bonds, or real estate. Planning ahead can help minimize the tax impact and maximize your gains. Here are some tips to help you plan for capital gains tax effectively:

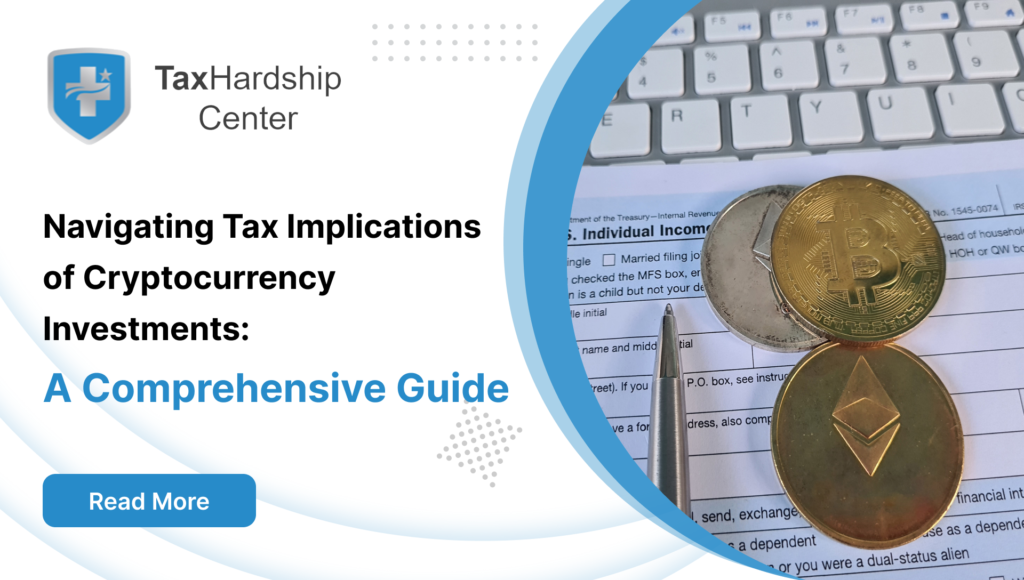

Navigating Tax Implications of Investments

Investing in the tech sector can be a lucrative endeavor, but it’s important to remember that tax implications can have a significant impact on your overall returns. Understanding the tax implications of your investments is crucial for maximizing your profits and avoiding potential pitfalls. In this article, we’ll explore the key considerations to keep in mind when navigating the tax landscape of tech investments.

Year-End Tax Strategies to Save You Money

As the end of the year approaches, now is the perfect time to start thinking about your tax strategy. By planning ahead and taking advantage of various deductions and credits, you can potentially save yourself a significant amount of money on your taxes. In this article, we will discuss some year-end tax strategies specifically tailored for those in the tech niche.

Tax Planning for Small Business Owners

As a small business owner, one of the most important aspects of running your business is proper tax planning. With the constantly changing tax laws and regulations, it can be challenging to stay on top of your tax obligations while also maximizing your tax savings. In this article, we will discuss some key strategies for tax planning for small business owners.

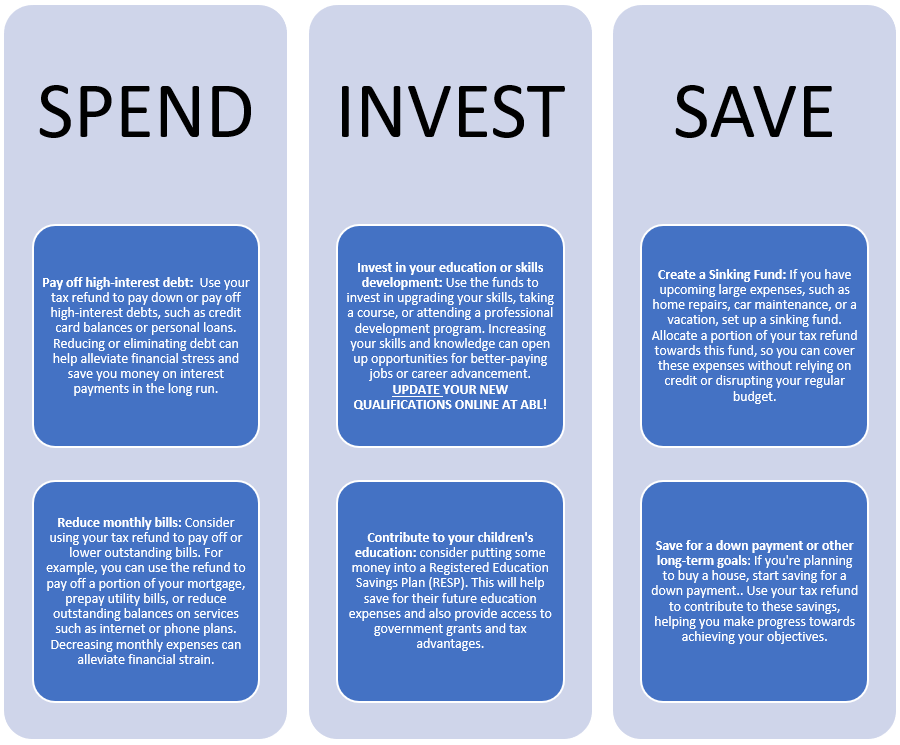

How to Maximize Your Tax Refund

With tax season in full swing, many people are looking for ways to maximize their tax refund. Whether you’re a seasoned tax filer or a newbie, there are strategies you can use to ensure you’re getting the most out of your refund. In this article, we’ll discuss some tips and tricks for maximizing your tax refund.

Best Tax-Saving Tips for Freelancers and Entrepreneurs

As a freelancer or entrepreneur in the tech industry, it’s crucial to maximize your tax savings to keep more of your hard-earned money. With the right strategies and deductions, you can minimize your tax bill and increase your bottom line. Here are some of the best tax-saving tips for freelancers and entrepreneurs in the tech niche: