Investing in the tech industry can be a highly lucrative decision, but it’s important to understand the concept of risk before making any investment choices. In this article, we will explore the differences between high-risk and low-risk investments in the tech niche, and provide you with the information you need to make an informed decision.

admin

admin

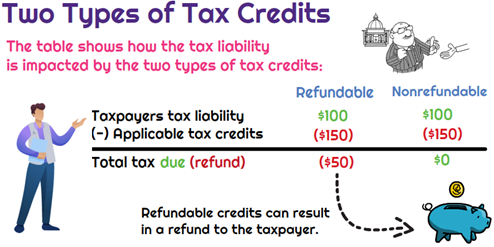

Understanding Tax Deductions and Credits

In the tech industry, tax deductions and credits can play a significant role in reducing your overall tax burden. By understanding how these deductions and credits work, you can maximize your savings and keep more of your hard-earned money in your pocket. In this article, we will explore the various deductions and credits available to tech professionals and provide tips on how to take advantage of them.

The Benefits of Hiring a Tax Planner

In today’s complex and ever-changing tax landscape, it can be difficult for individuals and businesses to navigate the various regulations and tax laws. That’s where a tax planner comes in. A tax planner is a professional who specializes in helping clients minimize their tax liabilities while ensuring compliance with all relevant tax laws. Here are some of the key benefits of hiring a tax planner:

How to Diversify Your Investment Portfolio

Investing in the tech industry can be highly lucrative, but it also comes with risks. One of the best ways to mitigate these risks is by diversifying your investment portfolio. Diversification is the practice of spreading your investments across different assets to reduce exposure to any one particular risk. In this article, we will explore why diversification is important in the tech industry and how you can go about diversifying your investment portfolio effectively.

How to Lower Your Tax Bill Legally

When it comes to taxes, finding legal ways to lower your tax bill is always a smart move. With the right strategies and proper planning, you can maximize your savings and keep more of your hard-earned money in your pocket. Here are some tips on how to lower your tax bill legally:

Personal Finance for Beginners: A Complete Guide

Managing personal finances can be a daunting task, especially for beginners. But with the right knowledge and strategies, anyone can take control of their financial future. In this comprehensive guide, we will cover everything you need to know to get started on the path to financial success.

How to Budget Effectively for Your Financial Future

Creating a budget is a crucial step in securing your financial future. By properly managing your expenses and saving strategically, you can ensure that you are prepared for any unexpected financial challenges that may come your way. In this article, we will discuss some tips on how to budget effectively for your financial future.

The Best Retirement Accounts for Long-Term Growth

Planning for retirement is essential for securing your financial future. One of the best ways to save for retirement is through retirement accounts that offer long-term growth potential. In this article, we will explore the best retirement accounts that can help you grow your savings over time.

Essential Tax Planning Strategies for Individuals

As a tech professional, you have likely focused on honing your skills and staying ahead in your industry. However, tax planning is just as important as staying up-to-date with the latest advancements in technology. By implementing effective tax planning strategies, you can minimize your tax liability and maximize your financial resources for future endeavors.

Personal Finance Tips for Building Wealth

When it comes to building wealth, personal finance plays a crucial role. Managing your money wisely and making smart financial decisions can set you on the path to financial success. In this article, we will discuss some key personal finance tips that can help you build wealth over time.