If you’re like most people, Social Security can be a confusing topic. The program is important for millions of Americans, providing financial assistance to retirees, disabled individuals, and survivors of deceased workers. In this article, we will break down the basics of Social Security, how it works, and what you need to know to make the most of this vital program.

admin

admin

Expert Tips on Building a Balanced Investment Plan

Investing in the tech industry can be a lucrative venture, but it also comes with its fair share of risks. To ensure that your investment portfolio remains stable and profitable, it’s important to build a balanced investment plan that takes into account various factors. Here are some expert tips to help you create a well-rounded investment strategy in the tech niche.

Investment Planning 101

Investing in today’s tech-driven world can be both exciting and overwhelming, especially for those new to the game. With so many options and opportunities available, it’s essential to have a solid investment plan in place to help guide your decisions and maximize your returns. In this beginner’s guide to investment planning, we’ll cover the basics of setting goals, evaluating risk, and building a diversified portfolio to set you on the path to financial success.

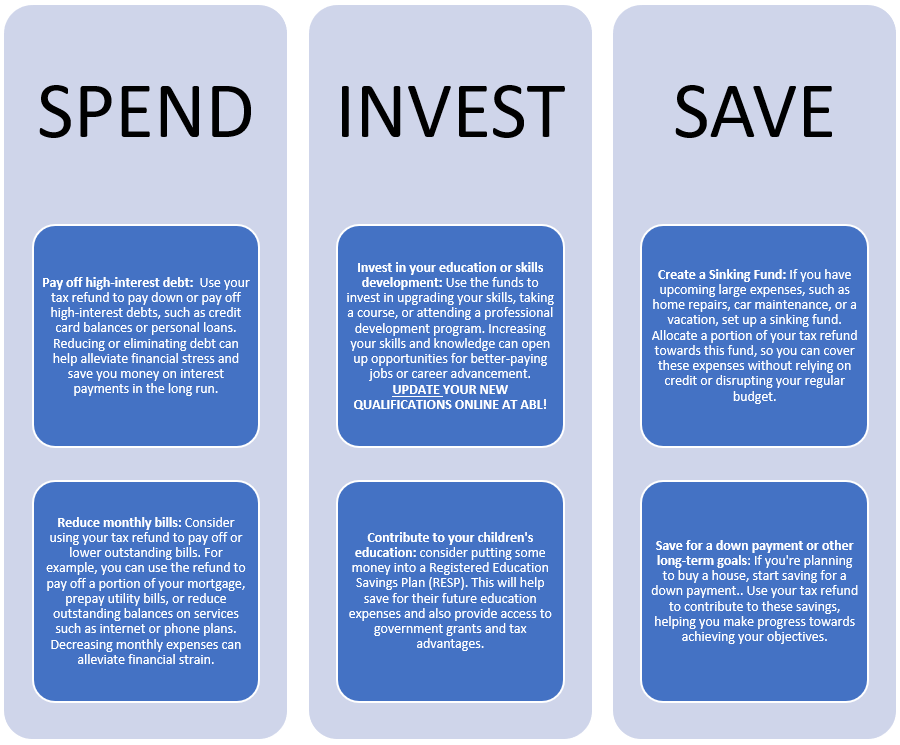

How to Maximize Your Tax Refund

With tax season in full swing, many people are looking for ways to maximize their tax refund. Whether you’re a seasoned tax filer or a newbie, there are strategies you can use to ensure you’re getting the most out of your refund. In this article, we’ll discuss some tips and tricks for maximizing your tax refund.

Retirement Planning Mistakes to Avoid

Retirement planning is a crucial aspect of your financial strategy. It involves making decisions about your future financial security and how you will support yourself once you stop working. However, many people make common mistakes that can hinder their ability to retire comfortably.

Managing Debt: Strategies for a Debt-Free Life

In today’s society, it’s not uncommon to find yourself drowning in debt. From student loans to credit card debt, many of us are struggling to keep our heads above water. However, with the right strategies and mindset, it is possible to achieve a debt-free life. In this article, we will explore some effective ways to manage your debt and work towards financial freedom.

Best Tax-Saving Tips for Freelancers and Entrepreneurs

As a freelancer or entrepreneur in the tech industry, it’s crucial to maximize your tax savings to keep more of your hard-earned money. With the right strategies and deductions, you can minimize your tax bill and increase your bottom line. Here are some of the best tax-saving tips for freelancers and entrepreneurs in the tech niche:

How to Save Money Fast: Proven Methods

Saving money can be a daunting task, especially when you are living paycheck to paycheck. However, with the right strategies and mindset, it is possible to start building your savings quickly. In this article, we will discuss some proven methods to help you save money fast.

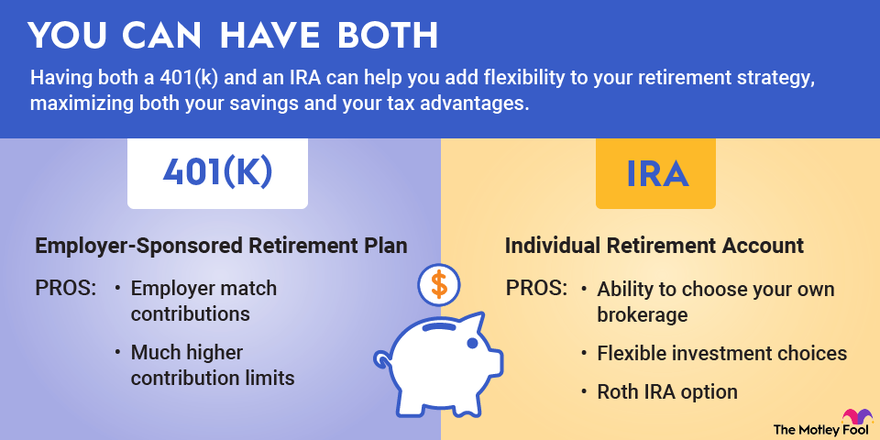

How to Maximize Your 401(k) and IRA Savings

When it comes to planning for retirement, one of the most important things you can do is to maximize your savings in your 401(k) and IRA accounts. These accounts offer valuable tax advantages and can help you build a secure financial future. In this article, we will discuss how you can make the most of your retirement savings by maximizing your contributions to your 401(k) and IRA accounts.

Smart Saving Strategies for Every Income Level

In today’s fast-paced world, saving money can be a challenge. However, with the right strategies in place, anyone can start building their savings, no matter what their income level may be. Whether you’re a high earner or living paycheck to paycheck, these smart saving strategies can help you achieve your financial goals.