When it comes to planning for retirement, one of the most important things you can do is to maximize your savings in your 401(k) and IRA accounts. These accounts offer valuable tax advantages and can help you build a secure financial future. In this article, we will discuss how you can make the most of your retirement savings by maximizing your contributions to your 401(k) and IRA accounts.

Understanding Your 401(k) and IRA

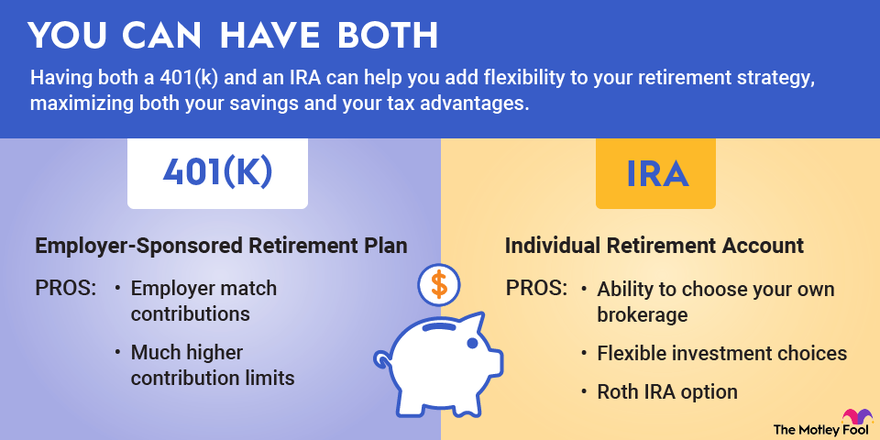

Before we dive into strategies for maximizing your savings, let’s first review what 401(k) and IRA accounts are. A 401(k) is an employer-sponsored retirement savings plan that allows you to contribute a portion of your pre-tax income to a retirement account. Contributions to a traditional 401(k) are tax-deductible, and your investments grow tax-deferred until you start making withdrawals in retirement. An IRA, or individual retirement account, is a similar type of account that you can open on your own. Like a 401(k), contributions to a traditional IRA are tax-deductible, and your investments grow tax-deferred.

Maximizing Your 401(k) Contributions

One of the best ways to maximize your 401(k) savings is to contribute the maximum amount allowed by law. For 2021, the contribution limit for a 401(k) is $19,500 for those under 50 years old, and $26,000 for those 50 and older. By contributing the maximum amount to your 401(k) each year, you can take full advantage of the tax benefits and compound interest that these accounts offer.

Take Advantage of Employer Matching

Many employers offer a matching contribution to your 401(k) contributions, up to a certain percentage of your salary. This is essentially free money, as your employer is matching your contributions dollar for dollar. Be sure to contribute enough to your 401(k) to take full advantage of this matching contribution, as it can significantly boost your retirement savings over time.

Maximizing Your IRA Contributions

Similar to a 401(k), one of the best ways to maximize your IRA savings is to contribute the maximum amount allowed by law. For 2021, the contribution limit for an IRA is $6,000 for those under 50 years old, and $7,000 for those 50 and older. By contributing the maximum amount to your IRA each year, you can maximize the tax benefits and growth potential of your retirement savings.

Consider a Roth IRA

In addition to a traditional IRA, you may also want to consider a Roth IRA. While contributions to a Roth IRA are not tax-deductible, withdrawals in retirement are tax-free. This can be advantageous if you expect to be in a higher tax bracket in retirement or want to diversify your tax exposure. Be sure to consult with a financial advisor to determine the best option for your individual situation.

Review and Adjust Your Investment Strategy

It’s important to regularly review and adjust your investment strategy to ensure that your retirement savings are growing at a steady pace. Consider diversifying your investments across different asset classes to reduce risk and maximize returns. Be sure to also periodically review your contributions and adjust them as needed to stay on track with your retirement goals.

Conclusion

Maximizing your 401(k) and IRA savings is essential for building a secure financial future. By contributing the maximum amount allowed by law, taking advantage of employer matching contributions, and reviewing your investment strategy regularly, you can make the most of your retirement savings and enjoy a comfortable retirement. Start maximizing your savings today and reap the benefits in the years to come.