As technology continues to advance and the world becomes increasingly interconnected, the need for reliable income protection has never been more important. For individuals working in the tech industry, where long hours and high stress levels are common, disability insurance is a crucial safety net that can provide financial security in the event of a disabling injury or illness.

Understanding Health Insurance and How to Save

Health insurance is a crucial aspect of financial planning for individuals and families. With rising healthcare costs, having the right health insurance coverage can provide peace of mind and protect you from unexpected medical expenses. In this article, we will discuss the basics of health insurance, how to choose the right plan, and tips on how to save on your health insurance premiums.

Retirement Planning Guide: Securing Your Future

Retirement planning is a crucial aspect of financial security, and it’s never too early to start thinking about it. Whether you’re just entering the workforce or nearing retirement age, having a solid plan in place can help ensure a comfortable future for yourself and your loved ones.

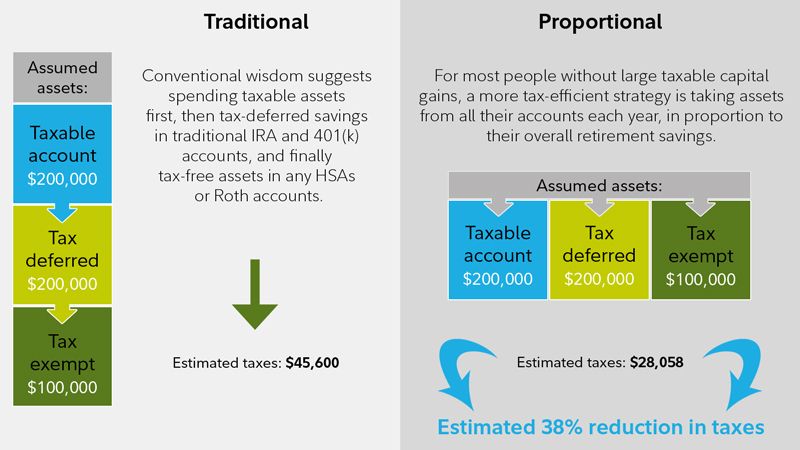

Tax-Advantaged Retirement Savings Strategies

Retirement planning is a crucial aspect of financial stability, and one key component of a successful retirement plan is maximizing tax advantages. By taking advantage of tax-advantaged retirement savings strategies, individuals can ensure that they are saving efficiently and optimizing their future financial security. In this article, we will explore some of the top tax-advantaged retirement savings strategies that tech-savvy individuals can use to build their retirement nest egg.

Understanding Stocks, Bonds, and Mutual Funds

Investing in the stock market can be a daunting task, especially for those who are new to the world of finance. However, understanding the basics of stocks, bonds, and mutual funds is essential for anyone looking to grow their wealth and secure their financial future.

How to Plan for Financial Emergencies

In today’s unpredictable world, it’s more important than ever to have a solid financial plan in place to help you weather unexpected emergencies. Whether it’s a medical emergency, a car repair, or a sudden job loss, having a financial safety net can provide peace of mind and ensure that you are prepared for whatever life throws your way.

Life Insurance: How to Choose the Right Policy

Life insurance is a crucial financial product that provides financial protection to your loved ones in case of your death. There are several types of life insurance policies available, including term life, whole life, and universal life insurance. It is important to understand the differences between these policies before choosing the right one for your needs.

Best Tools for Tracking Your Personal Finances

Managing personal finances can be a daunting task, but with the help of technology, tracking your expenses, budgeting, and saving money has become easier than ever. In this article, we will explore some of the best tools available to help you keep track of your finances and achieve your financial goals.

Passive Income Investment Ideas for Financial Freedom

When it comes to achieving financial freedom, passive income is key. Passive income streams allow you to earn money with minimal effort on your part, giving you the freedom to focus on other aspects of your life. In the tech niche, there are a variety of passive income investment ideas that can help you build wealth and secure your financial future. In this article, we will explore some of the top passive income investment ideas for those looking to achieve financial freedom.

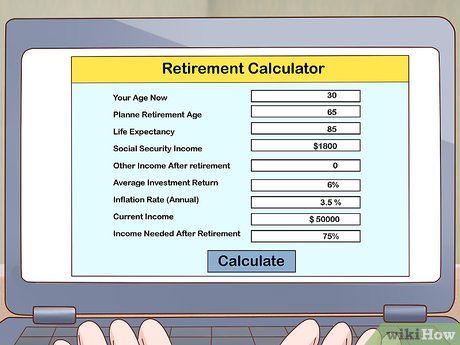

How to Calculate Your Retirement Needs

Planning for retirement is a crucial part of financial management. Knowing how much money you will need during your retirement years can help you save and invest wisely to ensure a comfortable lifestyle. In this article, we will discuss how to calculate your retirement needs.